27+ Mortgage borrowing capacity

To enhance consumer protections and disclosures for home mortgage transactions as part of the second phase of a comprehensive review comments due December 23 2010 Press release and notice. The dot-com bubble also known as the dot-com boom the tech bubble and the Internet bubble was a stock market bubble in the late 1990s a period of massive growth in the use and adoption of the Internet.

Leverage Ratio Formula Calculator Excel Template

In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial.

. 636a as added by section 1102. Call us today to find the best local mortgage Australia broker in your suburb. An eligible non-borrowing spouse can become ineligible over time if they move out of the property during the period that the reverse mortgage is in place.

The amount of money used as a down payment on a loan such as a mortgagebe it none 5 10 or 20is also important. 50 out of 5 stars. Homeowners facing financial hardship may be eligible for a mortgage payment deferral.

Must contain at least 4 different symbols. Full-function mortgage calculator LVR borrowing capacity Property upsizedownsize Principal payback milestone Break fee calculator Fix or float. 602 Percent Weekly Ending Thursday Updated.

That represents a drop of 21 on the month and about the same on 2021 numbers. On widely expected lines the Reserve Bank of India RBI on June 8 2022 increased its short term lending rate the repo rate by 50 basis points as the countrys apex bank tries to bring down inflation from an eight-year-high levelThe six-member monetary policy committee voted unanimously in favour of the rate hike. Get 247 customer support help when you place a homework help service order with us.

To revise the escrow account requirements for higher-priced mortgage loans comments due October 25 2010 Press release and notice. 30-Year Fixed Rate Mortgage Average in the United States MORTGAGE30US 2022-09-15. In an efficient market higher levels of credit risk will be associated with higher borrowing costs.

WPI inflation eases to 11-month low at 1241 in August Sep 14 2022. The eligible non-borrowing spouses age is factored into the loan to value calculation on the reverse mortgage loan because of the deferral option that they are eligible for. In June 2021 the authorities kept the existing flight restrictions limited the operating workforce of governmental and private institutions up to 50 percent shortened the school year and approved co-payment of Covid-19 tests for.

The deferral is an agreement between you and your lender. 26 Mortgage loan application means the submission of a borrowers financial information in anticipation of a credit decision which includes the borrowers name the borrowers monthly income the borrowers social security number to obtain a credit report the property address an estimate of the value of the property the mortgage loan amount sought and any other. Based on property value and may vary by lender.

It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Ness and capacity to timely meet his or her financial obligations and comply with the mortgage requirements and determine if the HECM will represent a sustainable solution to the mortgagors financial circumstances. In July 9709 mortgage loans were taken down from 12024 in June and 12064 in July 2021.

A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. Between 1995 and its peak in March 2000 the Nasdaq Composite stock market index rose 400 only to fall 78 from its peak by October 2002 giving up all its gains during. An important aspect of business borrowing is the form of security required - property or business assets.

Banks also look at the overall capacity for customers to take on debt. Typically the agreement indicates that you and your lender have agreed to pause or suspend your mortgage payments for a certain amount of time. Learn how to pick a mortgage based on your needs.

27 Given the significant consequences for creditors consumers and. Typical Reverse Mortgage Closing Costs. A Definitions--In this section-- 1 the term covered loan means a loan guaranteed under paragraph 36 of section 7a of the Small Business Act 15 USC.

In conducting this financial assessment mortgagees must take into consideration that some mortgagors seek a HECM due to financial. 6 to 30 characters long. William P of NSW 2209 - August.

Strengthen capacity in. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply.

That lenders charge you for the privilege of borrowing money that you can repay over. Up-front mortgage insurance premium. An interest rate is the amount of interest due per period as a proportion of the amount lent deposited or borrowed called the principal sumThe total interest on an amount lent or borrowed depends on the principal sum the interest rate the compounding frequency and the length of time over which it is lent deposited or borrowed.

ASCII characters only characters found on a standard US keyboard. RBI hikes repo rate by 50 basis points to 490. 2 the term covered mortgage obligation means any indebtedness or debt instrument incurred in the ordinary course of business that-- A is a.

The continued success of Mortgage Australia depends on every local Broker. A series of problems have been identified in mortgage markets within the Union relating to irresponsible lending and borrowing and the potential scope for irresponsible behaviour by market participants including credit intermediaries and non-credit institutions. Trade gap more than doubles to 2798 billion Sep 14 2022.

The first COVID-19 case was reported on March 21 2020 while community transmission started on April 27. The other half is choosing the best type of mortgage. Alcohol and Tobacco Tax and Trade Bureau TTB Bureau of Engraving Printing BEP Financial Crimes Enforcement Network FinCEN Bureau of the Fiscal Service BFS.

Exports rise marginally in August.

Nominal Interest Rate Formula Calculator Excel Template

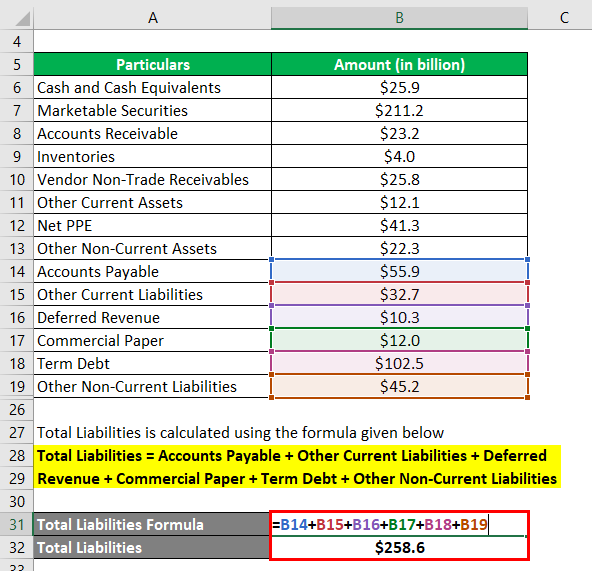

Net Debt Formula Calculator With Excel Template

Debt Ratio Formula Calculator With Excel Template

Revenue Formula Calculator With Excel Template

Net Worth Formula Calculator Examples With Excel Template

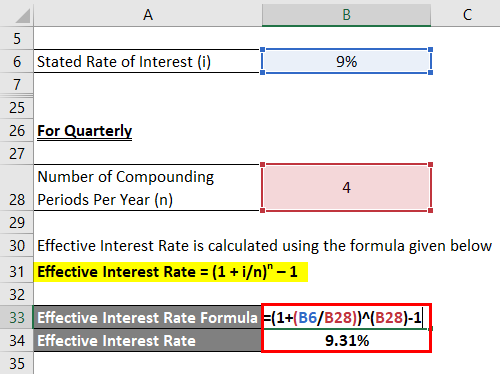

Effective Interest Rate Formula Calculator With Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

1

Debt To Income Ratio Formula

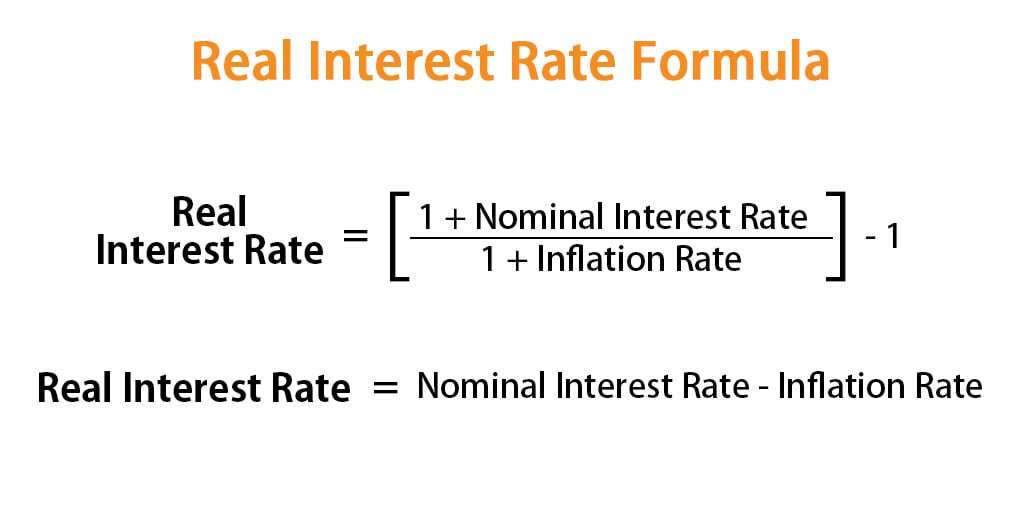

Real Interest Rate Formula Calculator Examples With Excel Template

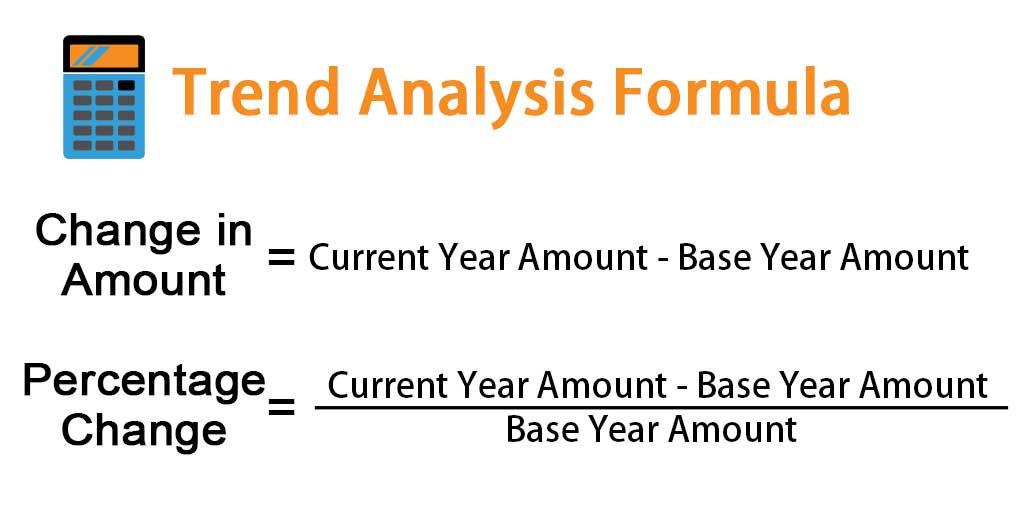

Trend Analysis Formula Calculator Example With Excel Template

Debt To Income Ratio Formula Calculator Excel Template

3

1

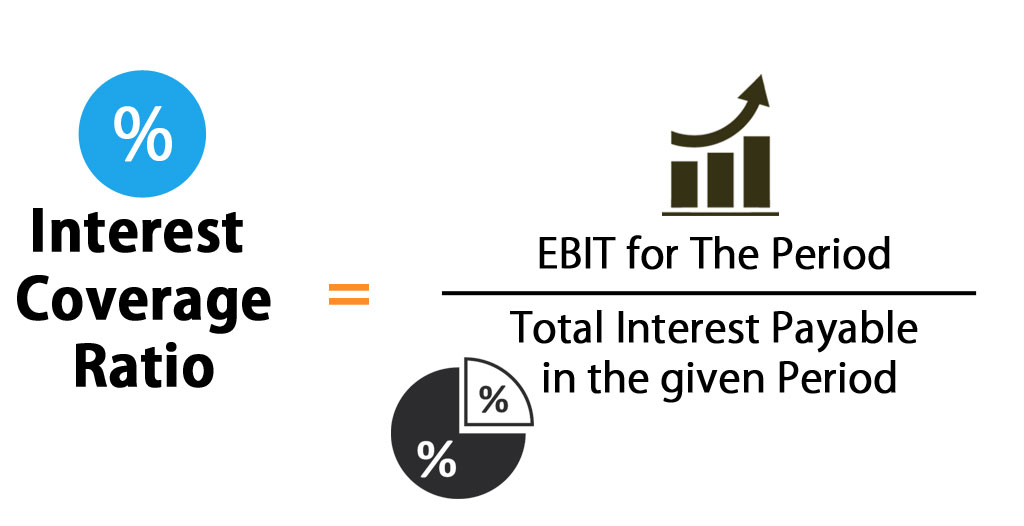

Interest Coverage Ratio Formula Calculator Excel Template

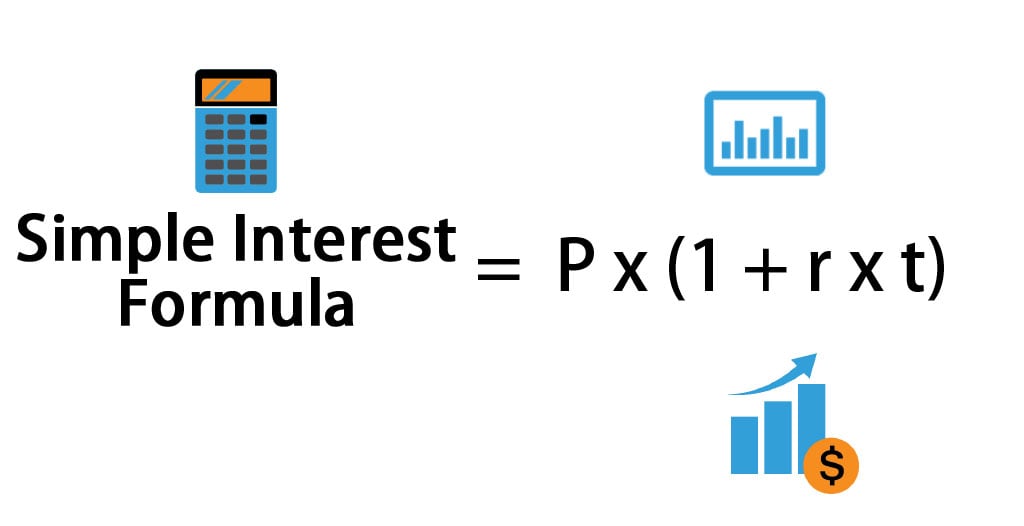

Simple Interest Formula Calculator Excel Template

Interest Formula Calculator Examples With Excel Template